Stable coins

Ah stable coins. The most ingenious approach to maintaining one's purchasing power in the crypto space. Will they stand the test of time or will central banks persuade regulators, to once again stifle innovation? We will be keeping a close eye on this sector.

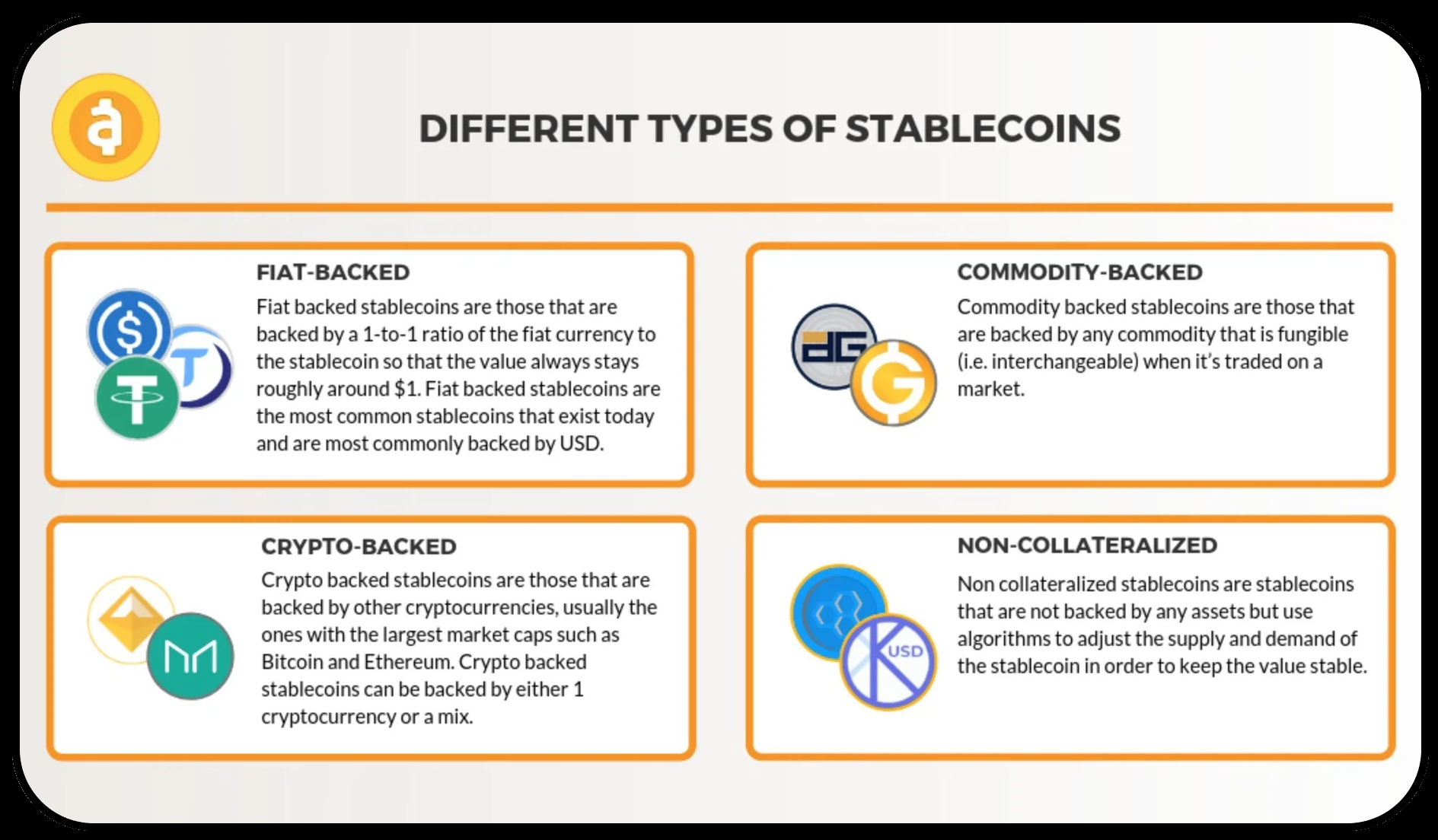

So what are stable coins? There is no need to complicate their definition though their importance and use case are vast and invaluable. Stable coins are simply assets pegged to another asset at a 1to1 ratio. Having 1 USDC (a stable coin pegged to the U.S. dollar named United States Dollar Coin) means you have 1 US dollar in value. Having 1 USDC means you can purchase $1 of Bitcoin. There are many stable coins. What's important to remember is the asset class it's backed by. Some are backed by different fiat currencies, some by gold, some by diamonds and some even backed by other cryptocurrencies.

Every stable coin pegged to the U.S. dollar In particular can be seen as U.S. dollars in crypto form. They share the same $ value. Any U.S. dollar pegged cryptocurrency is required by law to have at least as many U.S. dollars "secured" , as they do stable coins issued out to folks. To issue 1 stablecoin of some kind is to issue the same amount in current value of whatever asset its pegged to, like the U.S. dollar.

Unfortunately stablecoins have found their way back into the spotlight of some of the most heavy hitting regulators. Perhaps by the time you read this "about" section, things will be a little different.